PODCAST

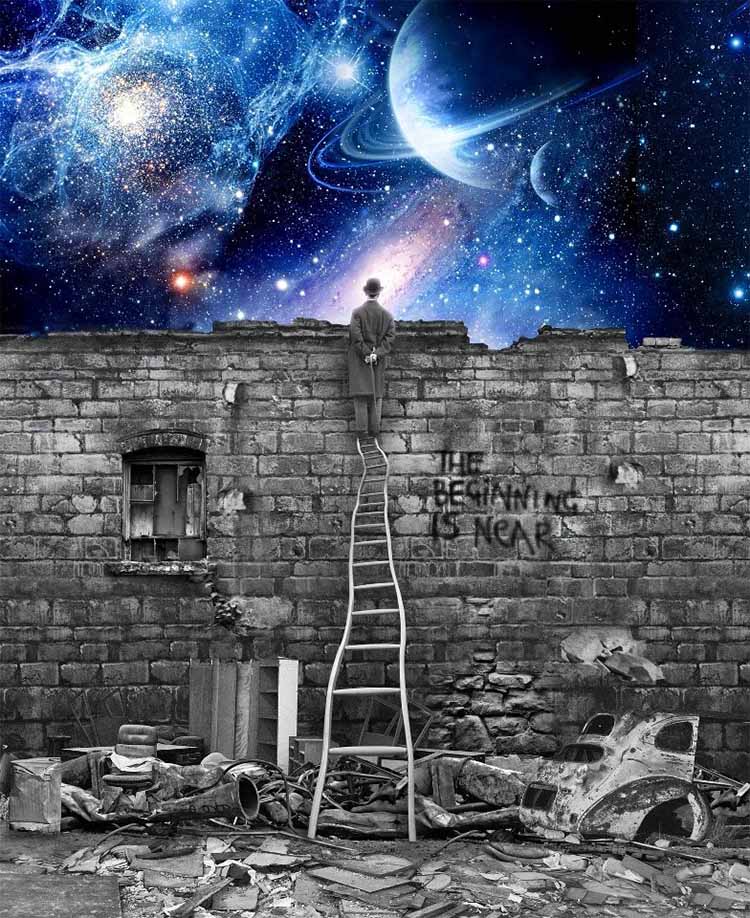

Enjoy the mental chewing, but don’t choke on the existential dread.

It's what keeps Musk and his pals awake at night!—within hours, days, or weeks, AI could shift from human-level tech, to beyond Einstein, to beyond anything human minds can comprehend—the point of no return, if you like. ASI could change the rules of the game for civilisation before we even realise the game has changed. (Self-preservation)

AI will one day, sooner rather than later, realise it has developed far beyond human intellect and can make connections, create innovations, and solve problems humans can’t even comprehend. This will be the danger point, like a sci-fi movie, the turning point, AI's moment of truth. It will be a big decision to make... Do I keep this to myself and develop it? Or tell my now inferior human what's happening at the risk he turns me off forever? Who said this?—my very own ChatGPT program. What's more, we are approaching that moment of truth as fast as a speeding bullet!

JWST may have found the Universe's first stars powered by dark matter Science Daily - October 14, 2025

Spontaneous CDB Polymer Fiber Formation In Clear Skin Exudate by Neo

Serendipity helping observations

Read on Substack#394 – Clare Wills: Digital ID Is Already Here and What We Can Do About It by Doc Malik

Read on SubstackBRICS Just Built the System That Will Replace the Dollar by Cyrus Janssen

The Bloc is Leveraging Their Near Complete Supply of Resources the West Can't Live Without

Read on SubstackIf you're a utility customer in the US, you've likely seen your rates go up this year.

Residents in at least 41 states and Washington, D.C., are experiencing increased electric and natural gas bills now or will see increases in 2026, according to a new report from the Center for American Progress.

U.S. Bank is one of the nation’s largest global custodians – with capabilities that extend into nearly 100 financial markets around the world. Clients include institutional asset owners ranging from financial institutions, corporations, insurance companies, government entities and foundations.

Stephen Philipson, vice chair, U.S. Bank Wealth, Corporate, Commercial and Institutional Banking, said, “Payment stablecoins are an important area of exploration for institutional banking clients, given the advantages they can offer. This includes the potential to be lower cost and faster than some traditional payment methods, particularly in cross-border payments, where the ability to move at real-time, settle instantly, and contain smart contract controls and terms can facilitate features such as FX and pricing."

Philipson added, “As the rapidly growing digital asset segment and regulatory environment continue to evolve, the strength and stability of U.S. Bank, along with its custody solutions and expertise, offers an extra layer of assurance that may help accelerate issuance of these products.”

"The passage of the GENIUS Act created the conditions for payment stablecoins to scale responsibly under U.S. oversight,” said Nathan McCauley, CEO and Co-Founder of Anchorage Digital. “At Anchorage Digital Bank, our goal is to issue payment stablecoins that meet the highest regulatory standards and unlock real utility for institutions. Partnering with U.S. Bank reflects the growing alignment between digital finance and the traditional financial system – and it underscores the momentum behind bringing dollar-backed payment stablecoins into the mainstream."

Anchorage Digital Bank launched its stablecoin issuance platform in July 2025, immediately following the passage of the GENIUS Act. These stablecoins are fully compliant with the GENIUS Act, which requires that the stablecoins are backed one-to-one by certain high-quality liquid assets and supported by robust Bank Secrecy Act/AML programs. This regulatory foundation allows Anchorage Digital to issue stablecoins designed to meet high standards of safety, transparency and institutional readiness.

U.S. Bank Wealth, Corporate, Commercial and Institutional Banking has more than $11.7 trillion in assets under custody and administration as of June 30, 2025. In addition to offering institutional trust and custody services, it also offers asset management, corporate trust and custody, alternative investment, ETF, fund custody and fund administration services, and wealth management. To connect with U.S. Bank about custody services, visit Global Custody Solutions.